Human to Pet Nutrition: Emerging Trends in Pet Claim and Attribute Preferences

(This is part two in a series of three white papers we’re calling Human to Pet Nutrition, which covers the crossover in the preferences that pet parents have for their nutrition products and their pets. Read part one.)

Executive Summary

For almost two decades, MarketPlace has lived at the intersection of human and pet nutrition and lifestyle trends. A full-service strategy and creative firm, we’ve cultivated leading human and pet nutrition and lifestyle brands for B2C and B2B companies—food, treats, supplements, and the ingredients that make them.

In May 2021, MarketPlace fielded a survey of pet parents to gain insight into their awareness, attitudes, and behaviors related to pet nutrition.

MarketPlace reported this data in our Human to Pet Nutrition: 2021 Pet Shopper Statistics white paper.

Here, as the second part of our series, we discuss supplemental insights and emerging product and promotion opportunities in pet inspired by purchase drivers and trends in human health and nutrition.

Methodology

MarketPlace conducted a survey of pet parents to develop insights into consumer perceptions and behaviors regarding supplements for pets. In June 2021, MarketPlace partnered with Dynata to conduct a survey of 506 U.S. pet parents who currently have at least one dog, cat, or horse. Findings from this study were presented at the 2021 Annual Conference of the National Animal Supplement Council.

Findings

Good For Me, Good For My Pet

Probiotics. Immunity. Made in the USA. Personalized nutrition.

For many pet parents, human-grade is an indicator of quality (although not necessarily a primary purchase driver—more on that later). Beyond ingredients, the influence of human nutrition trends in pet extends to need states, sourcing, sustainability, how they purchase products, and even where they seek information.

Data from our May 2021 survey (pet parents, n=506) reflects the continuing correlation between the attributes and benefits people seek for themselves and those they seek for their pets. Here, we consider how those insights may be applied in product development, branding, and promotional strategies for pet nutrition products.

A Natural Connection With Wellness

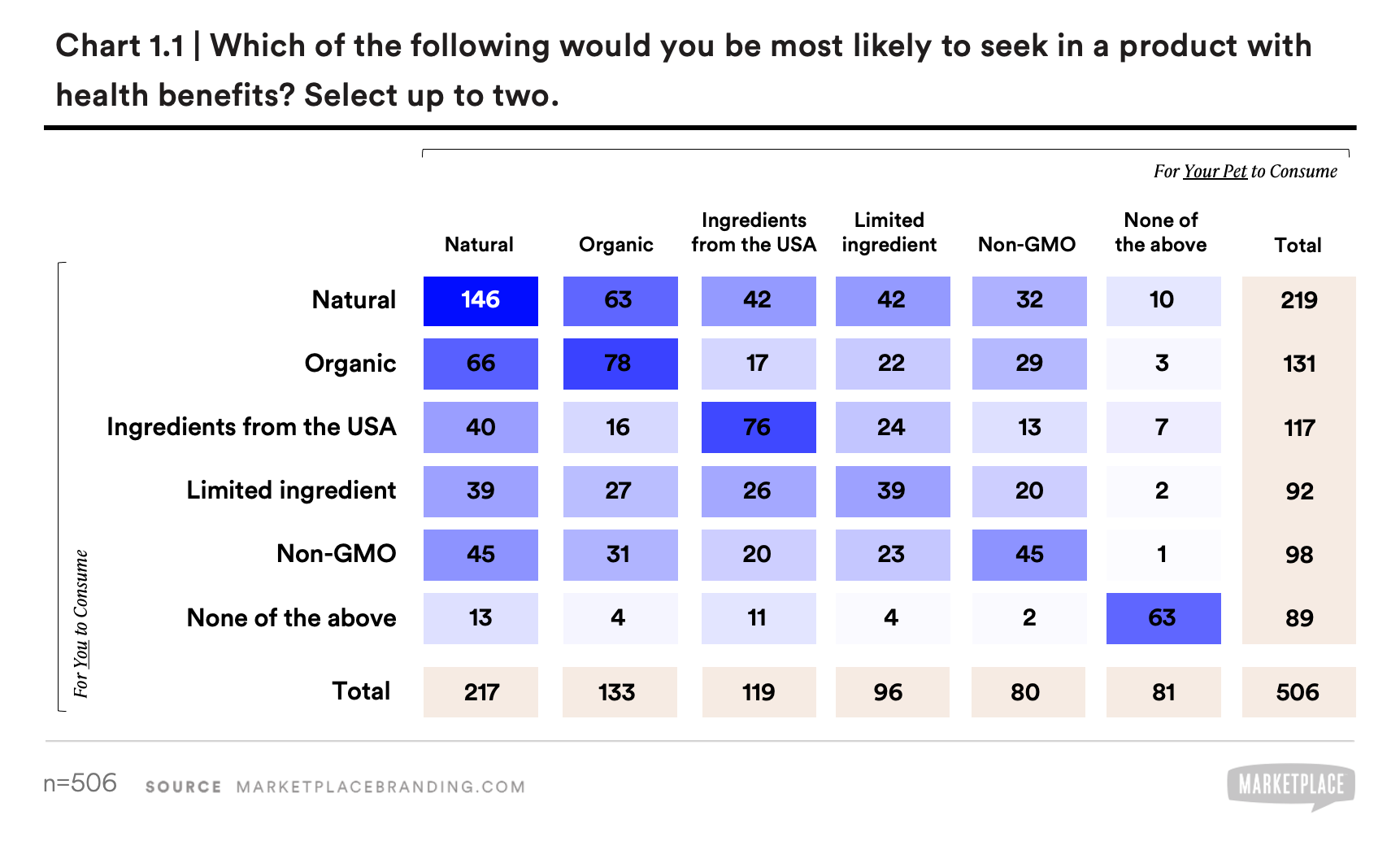

When asked what pet parents would seek in a consumable product with health benefits, naturalness was prized in both human and pet nutrition (see chart 1.1). Among the full panel of respondents, 43% (n=217) indicated that they would seek natural attributes in a health-oriented consumable for their pet.

When we look only at those who would seek natural products for themselves (n=219), the percentage of those who also sought natural health-oriented consumables for their pets climbed to 67% (n=146), a 56% increase compared to the general pet parent audience.

In addition to “natural,” “ingredients from the USA” (65%) and “organic” (59%) are likely to be sought for one’s pet if sought for oneself.

Of those who selected “natural” (n=219) as one of the top indicators of quality when selecting products for themselves, 37% indicated “made in the USA” as a top 3 indicator of quality in pet nutrition products, alongside clinical trials (34%) and specific ingredients (32%).

Given that “natural” sustains as a long-time trend in pet nutrition, with 40% more respondents seeking a natural claim than any other attribute tested, MarketPlace sees “naturalness” as a baseline requirement for those seeking to compete with a health-oriented position, such as in functional treats or supplements. Where clinical trials or demand-driving ingredients can distinguish a brand from others, a natural claim on its own is not uniquely differentiating.

Sourced, Made, and Certified

“Made in the USA” is a prevalent trend, visible on pet nutrition product packaging, Amazon product page content, and promotional content. In MarketPlace’s May 2021 pet parent survey, 68% of pet parents stated it is important that products they purchase for their pets are made in the USA.

Second to “made in the USA,” respondents indicated that “ethically sourced” (64%) was of notable importance when purchasing a pet product.

Much like “natural,” made in the USA is a meaningful descriptor, although not singularly differentiating. “Ingredients from the USA” is perhaps a greater opportunity to differentiate, since many brands in the pet nutrition space rely on ingredients sourced from around the globe. Given the additional sourcing stresses driven, in part, by COVID-19 supply chain disruptions, a 100% American-sourced and -made product could align with primary purchase considerations.

While messages “ethically sourced,” “manufactured from a transparent supply chain” (57%), and “Fair Trade Certified” (53%) could each reasonably be used to tell a shared story, the data indicates that certain messages—in this case, “ethically sourced” may resonate more effectively with the general audience. Of course, effective communication relies on displaying each message in the appropriate manner and location.

High-quality and Human-grade

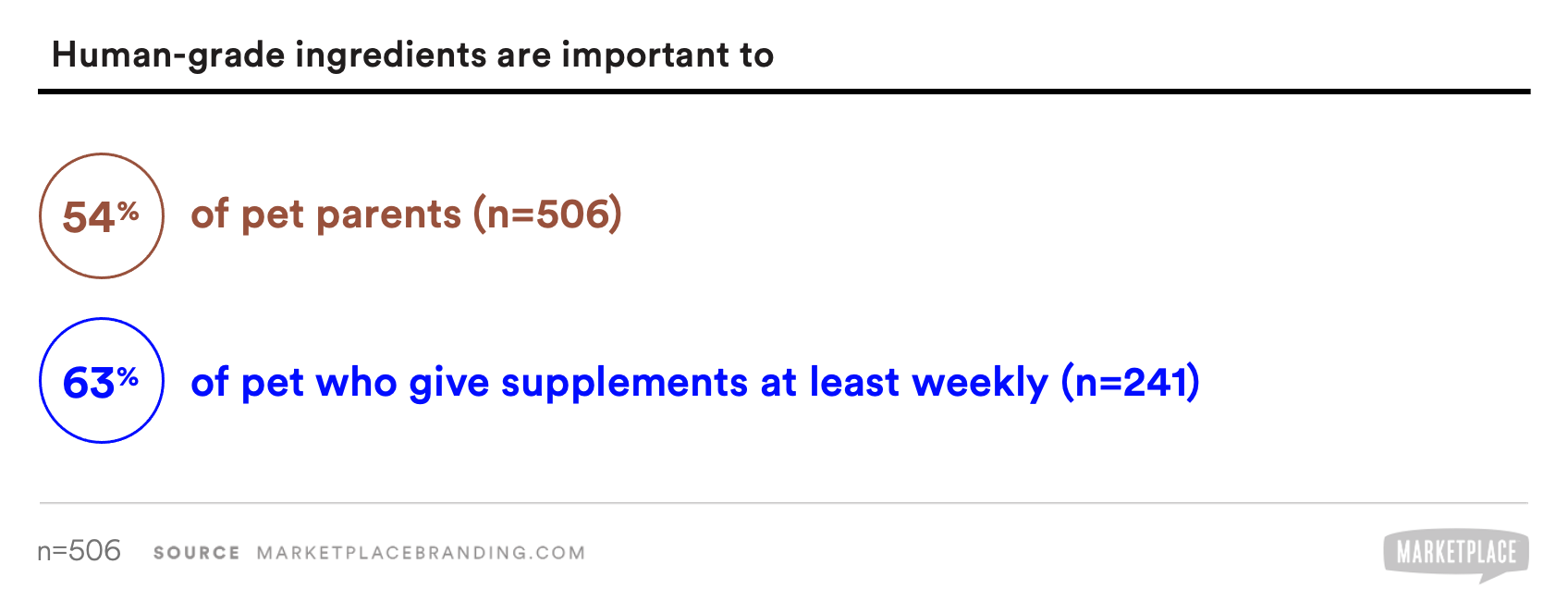

Among pet product considerations, a majority of pet parents indicated “human-grade” is an important attribute (see chart 2.1, above). But how important?

When offered alongside other indicators of quality in food, treats, or supplements, “human-grade” fell into the center of the pack, with 25% selecting it as one of their top two indicators of high quality.

With limited billboard on packaging Principal Display Panels (PDP) and online product title character count limitations, prioritization matters. “Kitchen sink” products that offer a vast array of features and benefits can’t communicate each attribute within a first impression. To communicate a product’s unique point of difference, while including the search terms that the right shopper would be most likely to use, MarketPlace often informs our approach with data-driven intelligence. Knowledge of the category, retail channel, competitors, and the audience that the brand best serves can support a more strategic approach to product positioning, design, messaging, and promotion.

While “human-grade” is an indicator of quality by the general pet parent audience, it is not a primary purchase driver. We would interpret this as a positive association, a nice-to-have, for the general audience that could support an overall brand position. As always, refining the definition of the audience more could change the weight of the importance of select product attributes.

Supplement Takers, Supplement Givers

When we seek a deeper understanding of the pet parent audience, we seek to define who a brand’s audience should be. Our goal is, ultimately, to connect people with the brand that best serves their needs and shares their values. And we help brands find their people.

Validating and invalidating initial theories can help to hone an audience and reduce confirmation bias. In this case, the data was, indeed, validating: in the supplement category, people who consume supplements themselves are more likely to be pet supplement shoppers.

Of those who take supplements at least weekly (n=368), 60% also give their pet supplements at least weekly, +12% relative to the general pet parent audience surveyed.

Among those who consume supplements themselves, it’s reasonable to interpret that an initial objection to supplements—that they’re ineffective or not necessary—is already overcome. They believe in the power of supplements; they are willing and able to purchase proactive health products. When defining a new audience or establishing targeting parameters for a digital campaign, these insights, paired with others, are applied to fine-tune positioning and promotional efforts.

Supplement-takers are 12% more likely than average to give their pet supplements.

Building Trust in a Supplement Brand

Supplement consumption is largely based on trust. First, that supplements can work to proactively support health and wellness. Then, trust that one’s pet will consume them. And trust in the quality of the ingredients, the efficacy of the product, and in the credibility of the brand, which embodies all aspects of the customer experience.

For a new pet supplement brand entering the market, building trust can be a significant, and necessary, challenge. So, we sought those attributes that would instill, among pet parents, confidence in a pet supplement. Among the general pet parent audience (n=506), “vet recommended” (56%) was the top attribute associated with instilling confidence, followed by “clinically proven” (34%) and “all-natural” (21%).

Separately, we tested “veterinarian recommended” alongside other associations with efficacy. Again it earned top billing, with 25% of pet parents most associating “veterinarian recommended” with a highly effective pet nutrition product, nearly twice the number of respondents who selected “veterinarian formulated” (13%).

While data is only one piece of an informed product and brand development strategy, these insights may spur investment in confirming a “veterinarian recommended” message, for which AAFCO requires a statistically sound number of veterinarians. For a “veterinarian formulated” message, AAFCO notes that “it only takes one veterinarian to support the claim.”

At MarketPlace, we apply these insights when consulting on formulation, prioritizing validated on-pack claims, and informing content marketing efforts that support search engine optimization (SEO).

There is Always More to Know

Subscribe here for our white paper, which covers more on the crossover between pet and human nutrition trends with a focus on Personalized Nutrition, Demand-Driving Ingredients, Ecommerce, Subscription Services, and Cause Marketing.

If you have any questions or would like to request more information about our study, please contact us at hello@marketplacebranding.com.

Working With MarketPlace

Founded in 2002, MarketPlace is a strategic partner to health and wellness, pet and animal, and food and beverage brands. Through business strategy, industry focus, and marketing expertise, we help our partners grow.

If you’re working to launch a pet supplement brand, we do that, too—let’s talk!